_edited.jpg)

The Impact Investing, Sustainability & Philanthropy Majlis, is a three-day summit, with an embedded fellowship, in Dubai for high-impact decision-makers - primarily funders -looking to deploy capital as a force for legacy and transformative impact.

Guided by the theme “Transforming Capital into Impactful Legacies,” the Majlis will convene family offices, HNIs, private equity and venture capital leaders, and philanthropists. Participants will engage with sovereign wealth funds, DFIs, banks and financial institutions, ESG leaders, and innovators through roundtables, deep dives, and workshops focused on mitigation technologies, climate resilience, nature-based solutions, circular economy financing, and tech-enabled social ventures, among others. Participating organisations will be able to connect and engage with a global audience while our Fellows will leave with a sharper understanding of the impact landscape - and a personal capstone to guide their values-driven capital deployment.

Select Confirmed Participants

Event Preview

Event Testimonials

80+ Decision Makers

(By Invite Only)

Convened Funders with $1 trillion+ AuM

19 Hours of Rich Content by Leading Experts Over 3 Days

Past Events

Past Fellowships

ORF conceptualized, designed, and delivered several high-profile fellowship programmes, bringing together a diverse group of professionals from across sectors. Notably, the Raisina Dialogue Fellowship convenes emerging leaders and diplomats from around the world for a unique policy and leadership experience.ORF Fellows are regularly invited to participate in the ORF global government summits and international events, reflecting the institution’s deep engagement with policymaking communities worldwide.

Previous Roundtables

Amaly Legacy has hosted banks, philanthropic foundations, impact investors and innovators in various roundtables. At COP28 it hosted the Rockefeller Foundation, Bayer Foundation, Community Jameel, HBAR Foundation, HSBC, KPMG, UAE Ministry of Education, among others exploring themes at the nexus of impact investing, philanthropy and innovation.

Social & Climate Innovation Demos

The Majlis in collaboration with the UAE's largest innovation accelerator has curated a group of social and climate ventures and projects to present to our audience a series of real-world innovations delivering impact. We have leveraged our extensive network and past experience in diverse innovation programmes with IRENA, Plug AND Play, HSBC, among others for this programme

Select Featured Innovators

Angel Network Alliance Partner

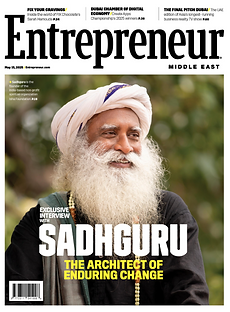

Media Partner

We are incredibly proud to have Entrepreneur Middle East as this year's Majlis' Media Partner. With a wealth of experience managing marquee events and leading media coverage for events in the Middle East region.

Diverse Perspectives on Real World Impact: Changemakers at the Impact Majlis

At the Impact Majlis we showcased what real world impact means to different stakeholders from diverse perspectives and geographies. We presented truly inspirational stories as part of our storytelling workshop by a number of inspiring changemakers and impact leaders. This session was led by Amaly Legacy and Global Energy Alliance for People & Planet (Alliance b/w Rockefeller Foundation, Bezos Earth Fund and IKEA Foundation) featuring Women of Will Malaysia, Bring Hope Foundation, Jusoor, Fundacion Azteca, IRENA, GEAPP and AlWaleed Philanthropies. Below are glimpses into how these changemakers view impact from their lense.

Join As a Speaker

Connect

Connect with institutional funders, corporations, innovators family offices and HNIs

Engage

Engage in dialogue and spark partnerships with key impact ecosystem skateholders

Share

Share your organisation's latest achievements and work that inspire impact and partnerships

Programme Highlights

Breakfast: 8.30-9.10

Session: 9.15 - 10 am

#MajlisObjectives

Opening Remarks by Dignitary & Majlis Host Followed by a Fireside

Following a networking breakfast, the Majlis commences with opening remarks that set the core objectives and tone for this high-impact convening focused on transforming capital into enduring legacies. Here we will frame the critical themes shaping the next three days: impact investing, strategic philanthropy and corporate sustainability. Laying the foundations by defining what impact and legacy mean from different vantage points, who funds impact today, who are recipients of funds and implementers of projects and initiatives that deliver impact, and the important roles of diverse stakeholders that enable, catalyse and deliver impact.

-

Defining Impact & Legacy: Gain clarity on the meaning of impact and legacy from diverse perspectives of attending stakeholders

-

Who Funds & Who Delivers Impact: Discover the types of funders and changemakers attending the Majlis

-

Diverse Stakeholder Roles: Gauge the diverse objectives of participating stakeholders

Time: 10.00 - 10.50 am

#DFIs #Sovereigns

#Co-Investments

#PortfolioOptimisation

Panel: Impact Investing by Sovereigns and Development Finance Institutions: Middle East Leadership and Global Perspectives

Examine how the world’s largest sovereign-linked funders are reshaping impact investing, financing and philanthropy at scale. As the global impact investing market surpasses $630 billion in 2025, sovereign wealth funds and development finance institutions are crafting strategies that deliver both strong financial returns and measurable societal outcomes. This opening session convenes leading actors to explore how impact is no longer a trade-off but a driver of long-term value. Panelists will examine how they structure deals, assess material ESG risks, embed impact KPIs into mainstream portfolios, and deploy catalytic capital to unlock private sector co-investment.

-

Scale & Influence: Learn how major institutional sovereign-linked funders are redefining impact investing at a global scale.

-

Combining Profit and Purpose: Discover how these institutions achieve financial returns alongside measurable social and environmental impact

-

Partnerships: Practical examples of collaborating to scale impactful investments.

Time: 10.50 - 11.30 am

#UAEHistory #Legacy

#SelflessService

#Photography

Reflecting on Selfless Service & Impact Through Historic Lenses

(Networking with a walkthrough of a curated photography collection)

An informal networking session, enriched by optional guided walkthroughs of historical images with inspiring stories of impact through diverse lenses. A visual journey reflecting on the contributions of early pioneers who had a very humble and small part in the Emirates’ social, environmental, and developmental journey prior to the UAE forming in 1971. From the first dental clinic in AlAin and the first photographer in Umm AlQuwain to leading business pioneers in Dubai and Abu Dhabi — instrumental in forging vital international relationships and development of key business sectors — these historical images narrate stories of humility, service, and selfless dedication.

-

Acts of Service: Reflect on how early pioneers in the Emirates engaged in acts of service and viewed impact from diverse lenses and walks of life.

-

Appreciation: Gain deeper appreciation for how past generations engaged in acts of service despite technological limitations and limited resources.

-

Empathy: Feel the joys and pains of early pioneers in their impact journeys.

Time: 11.30 am - 12.30 pm

#FundingLandscape

Workshop: Funding Impact: From Grants to Growth Capital and Innovative Instruments

This workshop aims to equip participants with a comprehensive understanding of the full spectrum of impact funding tools and dissect them — from pure grants and concessionary mechanisms to fully commercial investment vehicles — and to demonstrate how each instrument aligns with specific social and environmental objectives. Using a cashew value-chain case study, the session will highlight how hybrid funding models, calibrated to funders’ objectives, risk appetites and return expectations, enable transformative partnerships across public, private, and philanthropic capital.

-

Funding Landscape: Get a clear breakdown of funding options, from pure grants to commercial investment.

-

Blended Finance: Understand how combining funding types can manage risks and attract different investors.

-

Application: Learn how to choose and combine the best funding for specific projects.

Lunch: 12.30 - 1.30 pm

Session: 1.30 - 1.50 pm

#CircularEconomy

Fireside Circular Agri Value Chains: Redesigning Productivity, Finance, and Sustainability from the Ground Up

This fireside conversation takes a deeper dive into the practical application of circular economy principles within agri value chains, highlighting successful strategies that integrate circular practices, such as regenerative agriculture, waste reduction, and resource optimisation, into agri commodity supply chains and how it influences funding profile of these projects. The session will explore how circular economy approaches can improve productivity, enhance climate resilience, unlock financing and drive sustainable livelihoods for smallholder farmers. waddressing challenges related to resource management, community engagement, and environmental sustainability, ultimately aligning profitability with tangible social and environmental outcomes.

-

Circular Strategies in Practice: Learn successful integration of regenerative agriculture, waste reduction, and resource optimization within agri value chains.

-

Unlocking Sustainable Finance: Understand how circular economy principles enhance the funding appeal of agri projects.

-

Aligninment: Discover approaches combining financial profitability with measurable impact

Tea Break: 10 mins

Session: 2 - 3.15 pm

#Philanthropy#Grants #M&E#Partnerships

Roundtable: Mapping Philanthropy’s Role in the Capital Continuum for Systemic Social & Climate Impact

This session examines how global philanthropy is now structuring its own funding stack to accelerate social and climate solutions—often acting as the first‐loss or “patient” layer that unlocks sovereign, DFI and private‑sector investment and how philanthropic funding slots into the broader capital continuum explored earlier in the programme, and innovative approaches on structuring grant, concessional and catalytic layers that preserve financial discipline while driving systemic climate impact. Practical case studies on partnerships with family offices, a post-USAID era and key considerations for foundations when evaluating grant-making will be explored.

-

Strategic Giving: Learn how philanthropy can effectively kickstart and support larger social and climate investments.

-

Partnership Opportunities: Explore how foundations and family offices can partner strategically with other investors for bigger impact.

-

Applications: Understand approaches foundations use to amplify grant effectiveness.

Tea Break: 10 mins

Session: 3.25 - 4 pm

#CarbonCredits

#Co-Benefits

Workshop: Carbon Credits — Financing Climate Action while Catalysing Broader SDG Investment

This workshop explores an alternative innovative approach to funding development projects – carbon credits, examining what are carbon credits, how carbon pricing and credit markets are shaping global climate finance with a focus on nature-based solutions. Nature-based carbon credits are being viewed increasingly as an innovative mechanism to contribute to funding of community needs and sustainable infrastructure projects. In this workshop we will unpack ABCs of carbon credits to offering a commercial lens on structuring investable carbon projects and navigating market dynamics and exploring how philanthropic funding helps de-risk early-stage projects, supports market infrastructure, and complements credit pricing—bridging the gap between environmental ambition and financial viability. Most importantly, we will examine how sale proceeds of carbon credits can fund and derisk early-stage risks in development projects to attract larger private capital pools.

-

Demystifying Carbon Credits: Understand carbon markets and their potential to finance diverse SDG-aligned impact projects across education, healthcare, energy access etc.

-

Risk Mitigation Tool: See how carbon credits provide catalytic finance, lowering barriers for investments in healthcare, education, and water projects.

-

Commercial Viability: Acquire practical know-how on navigating market dynamics.

Time: 4 - 5 pm

#NatureFinance

#ImpactInvest

#NaturalCapital

Panel: Impact Investment: Opportunities in Nature-based Solutions (NbS)

As explored throughout the Majlis—from philanthropic capital structuring to catalytic sovereign strategies and circular economy innovations— NbS are emerging as a vital investment frontier that bridges climate goals with financial returns. This panel will spotlight how leading impact funds and institutional investors are scaling forest conservation, regenerative agriculture, blue carbon, and biodiversity-linked assets, now transitioning from grant-reliant pilots to market-ready opportunities. Building on the earlier discussion of philanthropic funding’s role, the session will expand on how blended finance and donor-backed risk layers are helping to de-risk NbS pipelines for private capital. Panelists will share actionable insights into the balance between climate mitigation, community livelihoods, and risk-adjusted returns.

-

Investing in Nature: Find out why nature-based solutions like forestry and regenerative agriculture are becoming attractive investment opportunities.

-

Beyond Climate Impact: Learn how investments in nature are creating wider impact on social causes and community development while enhancing project returns

-

Legacy: Understand how NbS unlocks transformation impact and community development

Philanthropy Alliance Partner

The Pearl Initiative is the leading independent, non-profit organisation working across the Gulf region to promote accountability, transparency, and governance best practices within the private sector and philanthropy. Established in 2010, we convene businesses, foundations, and family offices to foster a culture of responsible giving and governance-driven impact.

Select Corporate CSR, Sustainability & Innovation Participants

Asides from funders and innovators, we are convening sustainability and innovation ecosystem catalysts who are activating and driving meaningful impact across various industries

Join Our Majlis As a Fellow

Our Majlis has a curated programme for HNIs, Venture Capitalists and Family Offices who want to learn about impact investing, sustainability and philanthropy themes to shape their impact and legacy.

Event Logistics Partners

_edited_edited.jpg)

Contact Us

Please feel free to contact the hosts at Amaly Legacy or our Event Logistics Partner Make A Mark

email: strategic-affairs@amalylegacy.com

phone: +971 55 366 7777

Dubai, United Arab Emirates

*This is a private convening (by invite only) and location will be disclosed to confirmed attendees only

For logistical details please contact our event logistics coordinator at tala@makeamark.ae

%20(6).png)

%20(2).png)

%20(8).png)

%20(2).jpg)

%20(6).png)

%20(1).jpg)

%20(5).jpg)

.jpg)

.jpg)

%20(4).jpg)